MULTIWALK

A Framework for Algorithmic Development, Testing and Analysis

First place winner in 2025 Technical Analysis of Stocks & Commodities Magazine Readers’ Choice Award for software add-ons

When The Tool Doesn’t ExisT…

BUILD IT

MultiWalk was born out of necessity for my own algorithmic developement and trading. In 2015 I took Kevin Davey’s Strategy Factory Workshop. Kevin dramatically changed the way that I thought about and approached algorithmic development. I found there were aspects to algo development and his process that I wanted to explore and automate. I had a vision, but found that other trading tools did not encompass the vision of what I wanted. I have a professional background in software applications development and management. So I did what I do best in these situations. When the tool does not exist… build it! In 2017 a fledgling MultiOpt was born. In 2023 I completed a redesign and rewrite that became MultiWalk.

Algorithmic data analysis — Taking the walkforward process to the next level.

MultiWalk uses the walkforward process as taught by Kevin in his Strategy Factory Workshop. From a data science perspective, the walkforward process made sense to me. It is essentially a modeling-simulation process to evaluate trading systems. But I quickly found that it could be extended in ways that truly embraced its mathematical underpinnings to keep our trading algorithms freshly tuned with the current market dynamics they model. MultiWalk has been evolving as my own trading and algorithmic development process evolves, and continues to do so to this day.

Since I have automated some of Kevin’s methods, MultiWalk is currently only available to those who have taken his Strategy Factory Workshop. This is an exclusive bonus and benefit to Kevin’s students. I am pleased to be able to provide this work to the Strategy Factory Community. Read more about this important requirement here.

Products

MultiWalk

MultiWalk is used to develop trading algorithms and massively test them across many different symbol instruments, time frames and walkforward methodologies. It uses the TradeStation trading platform and can produce EasyLanguage strategy code that can be used in either TradeStation or MultiCharts.

MultiWalk Pro

MultiWalk Pro includes all MultiWalk features plus many more for advanced algo development and strategy management. It is a leap beyond the already poweful capabilities found in MultiWalk.

MultiWalk Features

Perform Optimizations and Walkforward Analysis

Using MultiWalk’s powerful backtest engine, perform optimizations and walkforward analysis across many different in-sample and out-sample period combinations.

Apply Strategy To Many Symbols and Bar Intervals

Take any strategy and apply it to multiple futures or stock symbols and bar intervals, up to four data streams!

Many Fitness Functions

Apply over 40 different analysis metrics and fitness functions to your project — at the same time! Easily and quickly identify trends and patterns across a variety of fitness functions using MultiWalk’s comprehensive reporting system.

In-Sample and out-of-sample (unseen data) testing

Define an in-sample and out-of-sample (Kevin Davey calls this Incubation) period. Run “blind” projects that hides the out-of-sample period until you are ready to simulate real-world trading for your project. This helps avoid self-deception by hiding your out-of-sample period until you are ready to simulate your incubation period.

Monte Carlo Analysis

Monte Carlo analysis is applied to every symbol/bar interval and walkforward entry in your project. It simulates thousands of random possible equity outcomes using the actual trade results of each walkforward entry and presents one simple-to-understand metric: profit return to risk drawdown.

Kevin Davey's Limited Feasibility Study

This module automates Kevin Davey’s Limited Feasibility Study. With this module, you will be able to use his method of testing a strategy on a small piece of data, but apply that to a broad range of symbols and bar intervals using MultiWalk’s multi-symbol/multi-bar interval capabilities.

Multi-Core/Multi-Threaded for speed

Both optimization and walkforward processes take advantage of today’s modern CPUs by running backtest simulations concurrently in multiple CPU threads. This dramatically decreases project run times. If you want to run multiple MultiWalk projects concurrently, you can also divvy up and allocate a specific number of threads per project.

Stop and Resume Project

Some projects can take hours to run and sometimes you want to manually stop the project to review results so far, or sometimes the project may give an error (such as strategy error or lack of data) and stop the project automatically. At times like these you don’t want to have to restart the project from the beginning, but rather resume where the project left off. The ‘Resume’ feature in MultiWalk allows you to do just that!

Generate easylanguage code

Quickly and easily generate walkforward EasyLanguage code for your strategy that can be applied to any TradeStation chart for trading.

Clear and Easy-To-Follow Workflow

There are many configuration settings in MultiWalk, so managing that complexity and providing an easy and understandable workflow when creating a project is important. Just work through each tab for your strategy to set up a project.

Comprehensive Reporting

Comprehensive reports for all walkforward analysis metrics, trades, equity data and more!

Automatic Recovery System

There are times that TradeStation becomes unresponsive during optimizations or would lose connection to the server and go offline. This meant that the project had to be stopped and restarted. MultiWalk now has an automatic recovery system that will detect when TradeStation is unresponsive or offline and automatically resubmit the current task to be completed later and then resume the project. This saves a great deal of time rather than finding that a project stopped at 1 a.m. in the morning and sat idle all night.

3rd Party Custom Symbol Support

MultiWalk fully supports 3rd party custom symbols, such as “@FGBX=108XC” or even “@LT2=108XC-122min”.

MultiWalk Pro Features

MultiWalk Pro includes TWO applications — MultiWalk and MulitWalk Trader. The MultiWalk Pro license includes all the features of the MultiWalk license plus many more. View the video or read below for the features included in MultiWalk Pro.

Algo Building Blocks

The Algo Building Blocks module gives you the ability to make any strategy input parameter a fixed, rather than optimized parameter. This means that you can create strategies with switch statements to select entry, exit, or filters of your own design. Using different combinations of code fragment building blocks can yield surprising results, especially when leveraged with MultiWalk’s abilty to test across massive number of symbols and bar intervals. Being able to fix parameters has other uses, also, such discovering which stop loss levels are appropriate for any given symbol and bar interval rather than trying to optimize a stop loss that may or may not be appropriate for the symbols and bar intervals in your MultiWalk project.

See the Algo Building Blocks Guide for more information.

MultiWalk Trader Strategy Management

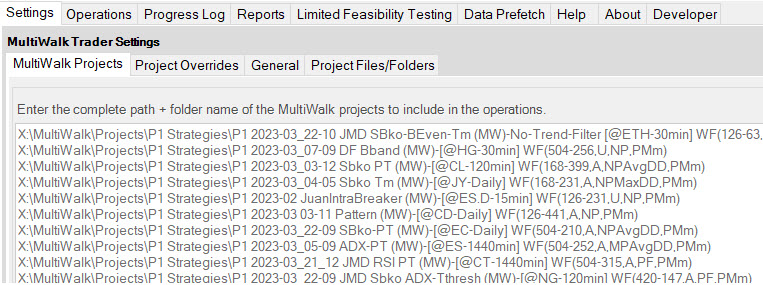

MultiWalk Trader is an advanced algo development and strategy management tool. It is primarily meant for the trader who already has algos developed and needs to manage them as a collective portfolio. However, it can also be used to queue up several MultiWalk “discovery” projects by executing them sequentially, one after the other. By collecting all your strategies together in one place as a “batch”, you can apply the full power of MultiWalk on each project and collect the results in one, unified reporting system.

Queue multiple MultiWalk projects

Run many MultiWalk projects back-to-back. This is helpful if you have several projects and want to maximize their run time. When one project completes, the next will immediately start.

Manage Re-optimizations

Walkfoward strategies need to be re-optimized and each strategy may have different re-optimization dates. MultiWalk Trader enables you to create consolidate reports for all your strategies so that you can easily identify which strategies need to be re-optimized. MultiWalk Trader also enables you to re-optimize all your strategies with one click of a button.

Consolidated Performance Reports

Create consolidated performance reports so that you can see, at a glance, the performance of all your strategies.

See the Quick Start Guide for more information.

Additional Walkforward Period Types

Walkforward in/out periods can be defined according to period types. MultiWalk includes the period type trading days. MultiWalk Pro includes more options that are calendar based or based on number of trades in a period. These overcome most of the limitations found when using trading days.

Calendar based days bring consistency to reoptimization dates since they are fixed, unlike trading days that can change when symbol data is updated with corrections.

With MultiWalk Pro, you can define your walkforward periods using calendar days or number of trades. See this knowledge base article for more information on using walkforward period types.

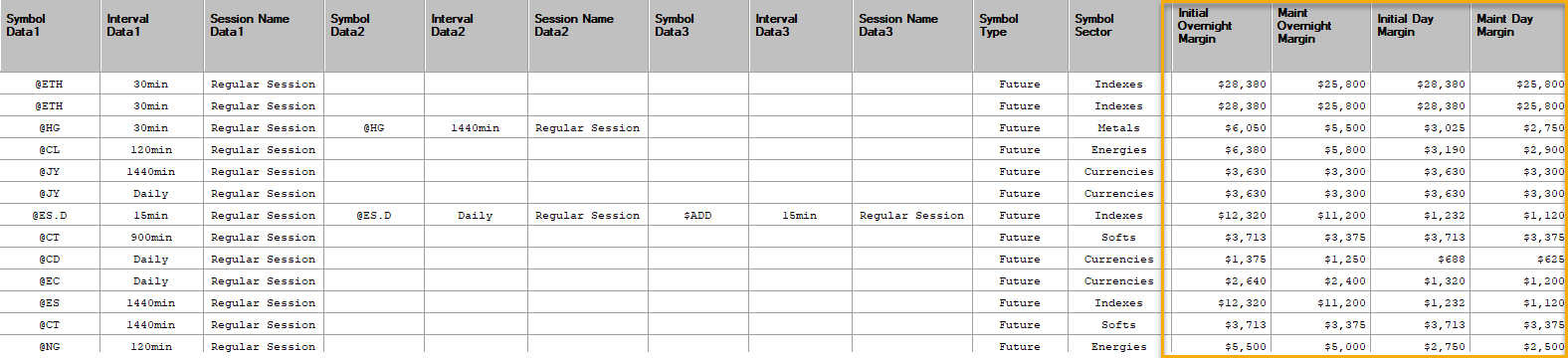

Automatic Margin Updates

Margin rates for futures are automatically updated using TradeStation margin requirements when you run MultiWalk. The margins are included in analysis reports for quick and easy identification.

Offline Processing - Symbol Data Prefetch

Once you create your project, use this module to download the symbol data into TradeStation’s data cache. This will allow you to run the project offline, freeing up your TradeStation login for other purposes.

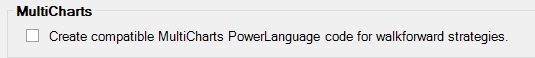

MultiCharts Support

While MultiWalk only runs under TradeStation, it can produce MultiCharts compatible PowerLanguage code:

Many MultiWalk users have set up a TradeStation account just so they can use MultiWalk. As a side benefit, you can even use TradeStation’s symbol data feed for MultiCharts, saving the cost of a data feed from another broker! See this knowledge base article for more information.

Non-Walkforward Strategy Support

Many people have wanted to leverage MultiWalk’s multi-symbol, multi-time frame capability for their own strategies that do not use optimization or walkforward process. They either want to:

- Run a non-optimized strategy against a variety of symbols and time frames. These “worker” strategies are normally not strategies at all, but instead strategies that create their own output files for use in an external analysis program, such as Excel or other trading platforms. See this article for a real-life use of this feature.

- Run an “optimization only” strategy and by-pass the walkforward process. These are for users that want to run their own optimized strategies and produce MultiWalk performance metric reports for the entire data range. See this article for more information.

MultiWalk Pro provides the means to run a non-walkforward strategy through its multi-symbol, multi-time frame system. You can then either use the MultiWalk reports to review results, or have your strategy write its own output result files!

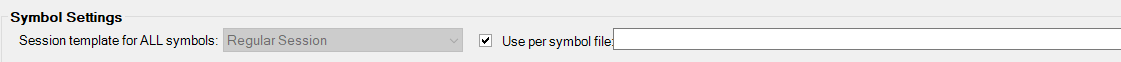

Apply custom session templates to individual symbols

Apply custom session templates to each symbol, not simply the entire project.

Testimonials

I have been using MultiWalk over the last year and can say this is a huge improvement to the previous MultiOpt software. If I had thought MO was pretty good and used to save me heaps of time in trading system development, I can confirm MW is an even bigger leap forward as it is faster, more robust, has more fitness functions and comes with a lot of new additional features that enhances trading system development.

My favourite new features include the algo building blocks (this one is really great to test multiple strategies with different entries and exits and check their robustness as well), data prefetch, the stop and resume project ‘button’ and MW Trader strategy management (mostly the re-optimisations management feature).

On top of all that, we can have top shelf customer support provided by Dave. Dave’s support has been nothing but flawless and spot on since the first day I became one of the MO’s users. He always replied to my enquiries and never took more than a few hours to do so.

I definitely recommend MW as a ‘go to’ software for system development and a mandatory tool in any retail algo trader’s (little guys like us…) bag of tricks.

A. Costa. (Sydney, Australia)