Specifying Symbols and Bar Intervals

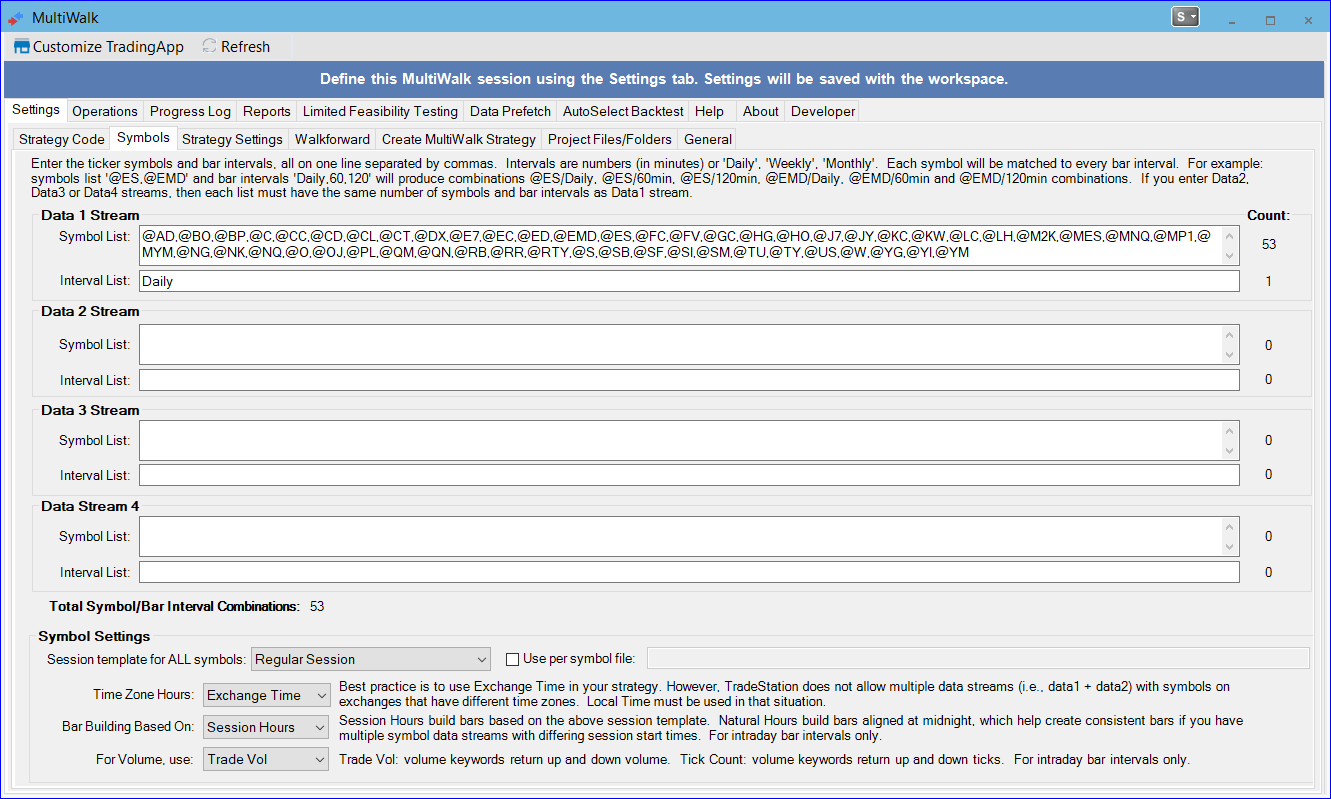

The Settings->Symbol screen is used to specify the symbols and bar intervals that will be used in your MultiWalk project.

Symbol List

The Symbol List is a comma-separated list of symbols to analyze. For example, an extensive analysis across many markets could be:

@AD,@BO,@BP,@C,@CC,@CD,@CL,@CT,@DX,@E7,@EC,@ED,@EMD,@ES,@FC,@FV,@GC,@HG,@HO,@J7,@JY,@KC,@KW,@LC, @LH,@M2K,@MES,@MNQ,@MP1,@MYM,@NG,@NK,@NQ,@O,@OJ,@PL,@QM,@QN,@RB,@RR,@RTY,@S,@SB,@SF,@SI,@SM,@TU,@TY, @US,@W,@YG,@YI,@YM

If there are no Data2, Data3, or Data4 streams, then leave them blank. Otherwise, they must have the same number of symbols as defined in Data1. For example, If you have an inter-market strategy that you want to test on index futures and Data2 is always going to be fixed using the symbol $UTY, then you would define Data1 and Data2 as follows:

- Data1: @ES,@EMD,@NQ,@RTY,@YM

- Data2: $UTY, $UTY, $UTY, $UTY, $UTY

Interval List

The Interval List is a list of comma-separated time frame intervals, such as “60,240”, where N will equal number of minutes for intraday charts. You can also use “Daily”, “Weekly” or “Monthly” to indicate daily charts, such as “Daily,60,240”. This will create three time frames for each symbol (daily, 60 minute, and 240 minute).

The interval lists for Data2, Data3, and Data4 (if used) must contain the same number of intervals as Data1.

To make this easier to see, consider the following data1/data2 examples.

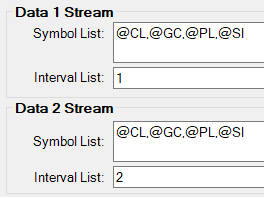

Example #1

Data1 intervals are set to 1 and the Data2 interval list to 2.

This creates the following combinations:

- CL-1min + CL-2min

- GC-1min + GC-2min

- PL-1min + PL-2min

- SI-1min + SI-2min

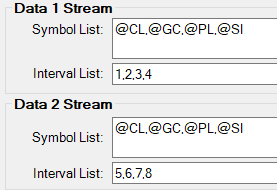

Example #2

Data1 intervals are set to 1, 2, 3, 4 and the Data2 interval list to 5, 6, 7, 8.

This creates the following combinations:

- CL-1min + CL-5min

- GC-1min + GC-5min

- PL-1min + PL-5min

- SI-1min + SI-5min

- CL-2min + CL-6min

- GC-2min + GC-6min

- PL-2min + PL-6min

- SI-2min + SI-6min

- CL-3min + CL-7min

- GC-3min + GC-7min

- PL-3min + PL-7min

- SI-3min + SI-7min

- CL-4min + CL-8min

- GC-4min + GC-8min

- PL-4min + PL-8min

- SI-4min + SI-8min

Every symbol is run against every interval set for data1/data2/data3. The first interval set in this example is 1,5 for every symbol, the next set is 2,6, etc.