Specifying Strategy Parameter Ranges

Strategy Parameter Ranges

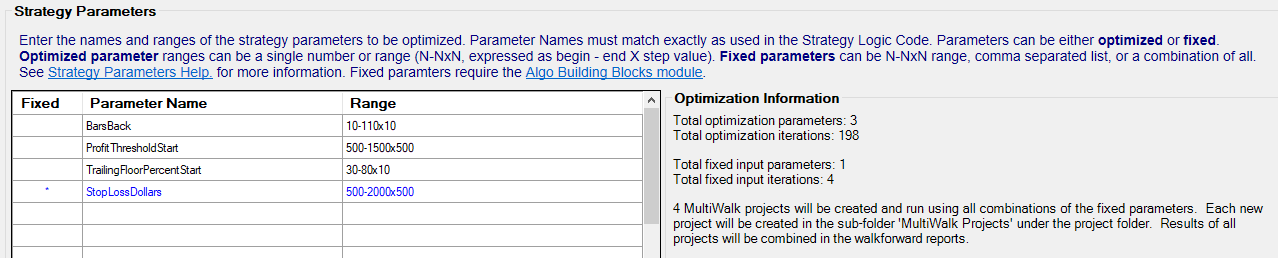

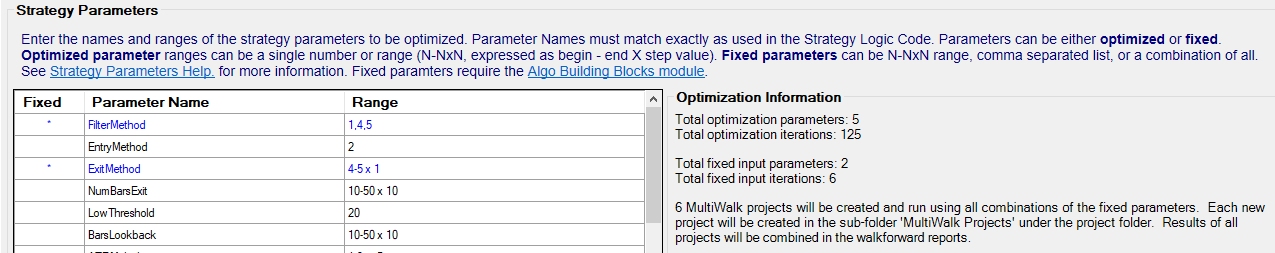

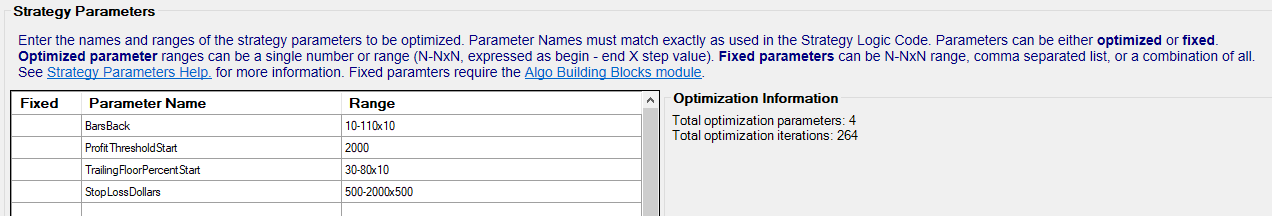

There are two types of parameter ranges: Optimized Input Parameters and Fixed Input Parameters. These parameters are the actual variable names that you use in your strategy to either optimize a parameter or hold the parameter constant. A MultiWalk project can have combinations of both optimized and fixed input parameters.

Optimized Input Parameters

When you write a strategy, you will choose what parameters (variables) you would like to optimize for that strategy. MultiWalk will use the TradeStation platform to optimize the strategy using their Optimization API. For this reason, optimized variables must conform to their usage and can be either a single number (which means it will not be optimized) or a range of values with a step factor to increment the range.

Fixed Input Parameters

Fixed input parameters require the Algo Building Blocks module. Fixed Input Parameters give you the ability to hold one or more strategy parameters “constant” during optimization. This is important, for example, if you wanted to test a range of stop loss amounts, but keep them fixed rather than optimize them, or create a “switch” statement to select different Algo Building Blocks to use in the strategy.

Please see Using Algo Building Blocks And Fixed Input Parameters for more information.

Range Format with Examples

Optimized parameter ranges can be a single number or N-NxN range expressed as begin – end X step value.

Fixed parameters can be N-NxN range, comma separated list, or a combination of all.

Optimized Parameter Examples:

Optimized and Fixed Parameter Examples: