Understanding MultiWalk’s use of trade size

For years MultiWalk has fixed the trade size to 1 contract during optimization to honor Kevin Davey’s testing methodology. However, in May 2025, MultiWalk now allows you to change the default trade size to better facilitate non-futures instruments, such as stocks, ETFs and Forex pairs.

However, this has introduced some nuances that are explained in this article. This is especially true if you also use MultiWalkNumContracts (or your own variable) for position sizing in your EasyLanguage code. See this article for additional important information on the use of MultiWalkNumContracts.

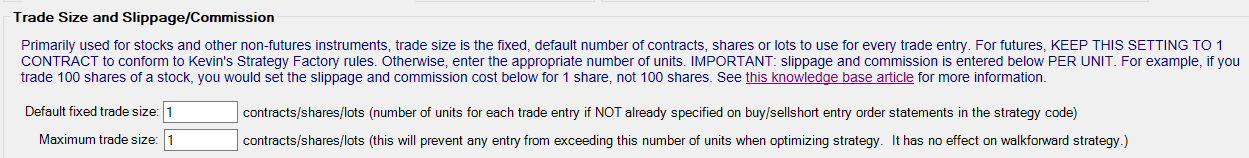

There are two settings in MultiWalk and TradeStation concerning trade size:

- Default fixed trade size setting

- Maximum trade size setting

In MultiWalk settings:

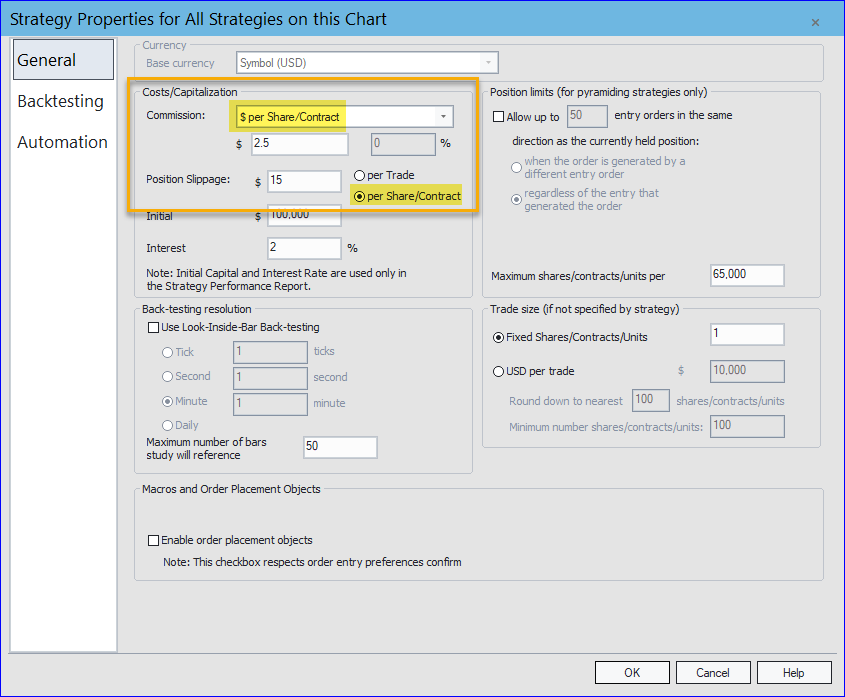

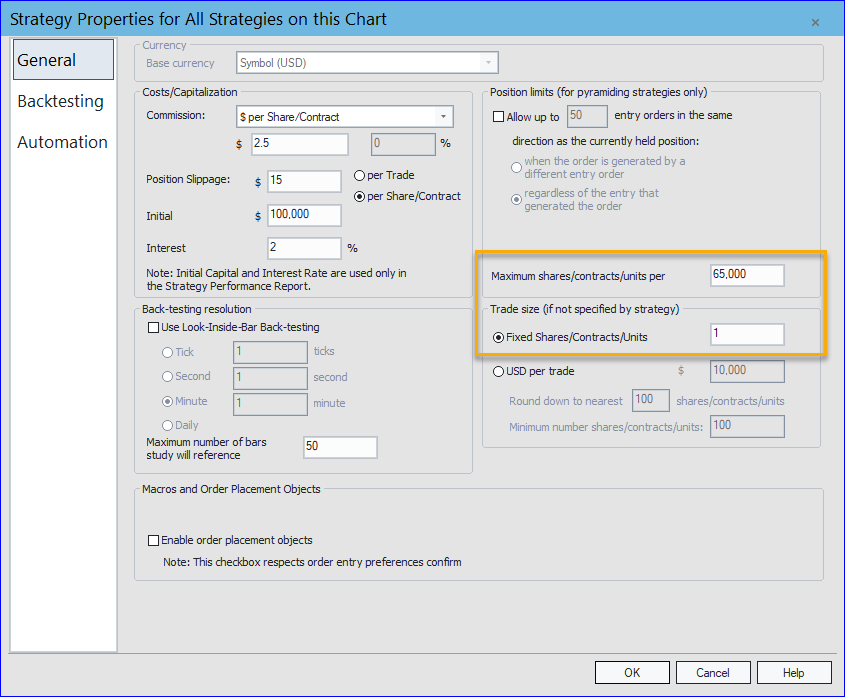

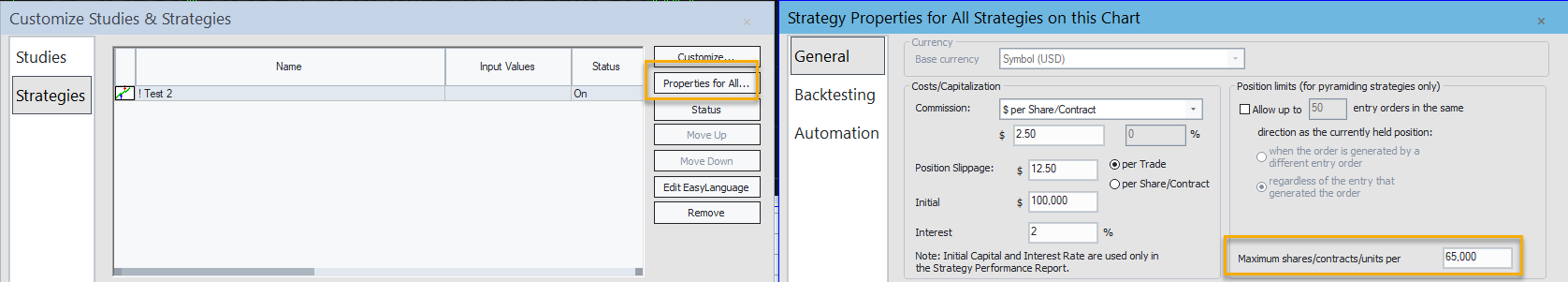

In TradeStation strategy properties settings:

Default Fixed Trade Size

If you do not specify the number of position units in your buy/sellshort statements (see the article on MultiWalkNumContracts for more information), then MultiWalk will use the position size specified in the Default Fixed Trade Size setting. In other words, specifying the units in buy/sellshort statements will OVERRIDE this MultiWalk setting. (Therefore MultiWalk strives to keep both in sync to avoid confusion between the two.)

For example, if you wanted to develop algorithms for stocks, you could set the trade unit size to 100 shares in MultiWalk. If you do not indicate the number of units in your entry statements, then something like “Buy next bar at market” would be the same as saying “Buy 100 shares next bar at market”.

Maximum Trade Size

The Maximum Trade Size is only used when optimizing the strategy in MultiWalk, but will NOT effect the walkforward strategy when you apply it to a TradeStation chart. The walkforward strategy does not enforce the same value used in MultiWalk so that you can use whatever position sizing method you want when running the strategy live.

Therefore, you must set this value your self within the TradeStation strategy properties. TradeStation sets the maximum trade size extremely high, so you may want to reduce that for your own trading needs:

Slippage/Commission Considerations

In MultiWalk, slippage and commission will always be based on 1 share or contract, regardless of the number of contracts or shares you specify in the Default Fixed Trade Size setting. Therefore, set slippage and commission values to “per share/contract” and amount based on 1 unit size in TradeStation: